Advertorial

How To Get Up To $10,000 In Credit Today (Without Suffocating Payday Loans)

Thousands of Americans are taking advantage of a new credit card offering higher limits at low rates, especially for people with bad credit. They even claim you get access to the money the same day you apply. So we did some research to see what all the fuss is about.

Do you know why Americans with bad credit, the people who need it most, are denied affordable credit cards?

You may think it’s because banks constantly lobby to keep laws in their favor and profit from your struggle. And that’s true.

But the main reason?

It’s because the industry hasn’t really progressed since the early 90s.

It relies on outdated models that punish people with credit scores below 619 with sky-high rates.

But that doesn’t make any sense because those same people would do better with affordable rates.

That’s why there’s a new credit card going viral for not charging different rates to different customers.

And it has nothing to do with predatory 400%+ APR payday or title loans, or pawn shops that suffocate you in debt and desperation.

It’s actually a Mastercard credit card from a company called Yendo.

They leverage modern technology to give you a revolving credit card at rates 95% cheaper than traditional non-bank loans, regardless of your credit score.

So how does it work?

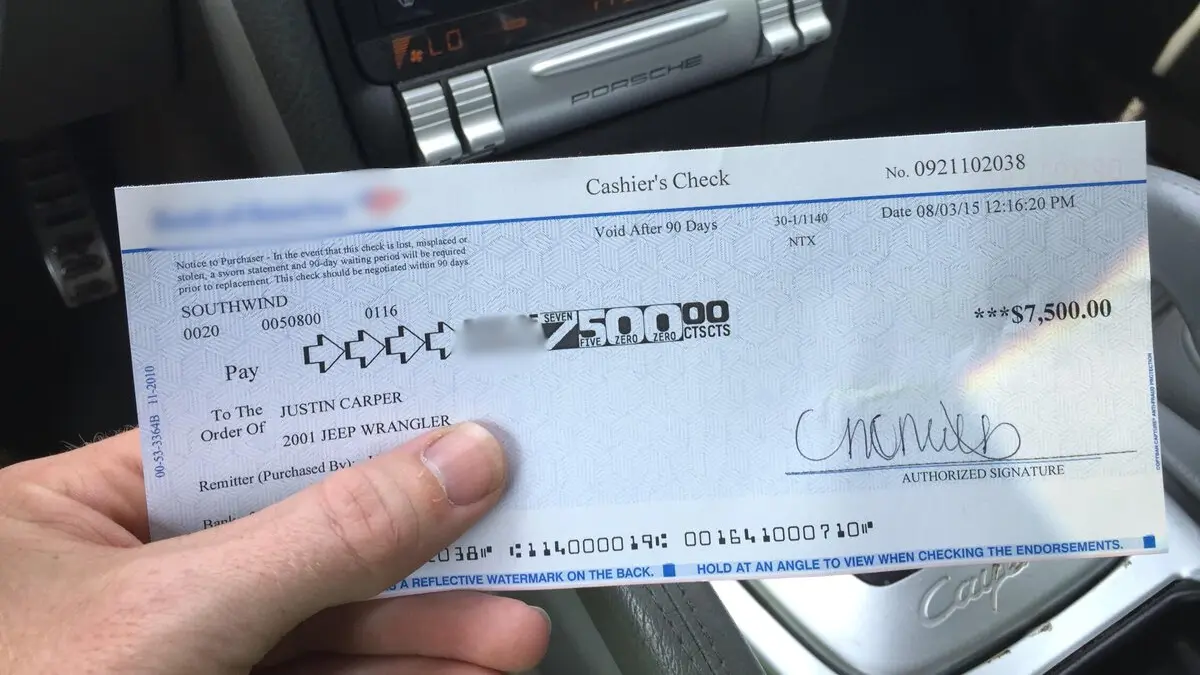

The Yendo Mastercard is the first credit card backed by your car.

It works like a regular Mastercard, but taps into your vehicle equity to get higher limits at the same affordable rates of unsecured prime credit cards that rich people have.

It gives you a line of credit (up to $10,000) you can use for emergencies, everyday purchases, balance transfers, or cash advances.

And the best part? If you make payments on time you will build your credit score. Yendo reports to Experian, Equifax, and TransUnion.

That’s why people love it. Here are some of the reviews we found:

Whether you’ve paid off your car or you’re still making payments, you can get approved in 3 minutes with no impact to your credit score.

Now you may be wondering:

This sounds great, but what’s the catch? The answer is none.

Yendo is here to reshape the lending industry. They’re backed by Mark Cuban himself.

He invested in the company back in 2021 for the “strong commitment to helping those who are underbanked and need financial support rather than extracting every dollar they can.”1

You see, using your car as collateral is not the nightmare you may think it is.

The truth is repossessions are rarely enough to cover the debt. And the whole process is just filled with complications, costs, and red tape for the lender. So they want to avoid it at all costs as much as you do.2

That’s why Yendo does not go after people’s cars unless they try all other options (repayment plan, vehicle trade-in, and others).

On top of that, the minimum payment is just 1% of the outstanding balance plus interest and fees, or $50, whichever is greater.

They’re also big on teaching people financial literacy. For example, Mark Cuban is helping Yendo partner with local businesses in related services such as credit repair.1

This is why Yendo is popular among savvy American savers who spend hours and hours researching before making financial decisions.

I’m talking about those smart people who somehow know how to stretch every dollar they can (especially when the economy is bad).

Those who, even when they’re at their lowest and desperate for help to get back on their feet, don’t let big companies take advantage of their vulnerability.

That is the typical Yendo customer.

Today, you get to stop missing out and finally get extra cash at the affordable interest rate you deserve.

The process is straightforward, simple, and secure. All you need is your smartphone, information about your car, and a valid ID to see if you qualify in as little as 3 minutes without harming your credit score.

Click your vehicle’s year below, submit your application, and find out how much you could get today!

What Year Is Your Vehicle?

![]()

Yendo credit cards are issued by Cross River Bank, Member FDIC, pursuant to license from Mastercard International © 2025 Yendo, Inc. All rights reserved.

James S., Dayton, OH

If you’re looking for that credit that you’ve not been able to come up with, Yendo is probably exactly what you’re looking for.

Robert B., Denver, CO

Yendo came in my life when I needed it most, when other companies were overcharging me for interest rates, and it really helped me out.

Sonya, Bradenton, FL

It’s not a title loan company. The process is easy and they make it worth your while.

Mela M., Phoenix, AZ

Yendo was quick and easy. Simply done from my phone. I hardly had to leave the couch and the interest rate worked great for our budget. So I recommend Yendo to anyone who will listen. I’d say at least try the process. You’d be very happy.

Footnotes