Advertorial

Why Millennials Pay Lower For Car Insurance

Millennials found an easy way to get their premiums as low as possible. Here’s how.

Thousands of young Americans are uncovering hidden car insurance savings in 2025. You can cut your bill by $600 or more in just a few minutes.1

Like many Americans, you’ve probably watched your car insurance premiums go up hundreds of dollars over the past two years.

Even as inflation cooled down, insurance prices stayed high.

But that’s not the case for everyone, especially millennials. And the reason is simple:

Millennials have no shame in shopping for a better car insurance company.

A survey revealed that 42% of millennials compare auto insurance prices yearly, the highest among all age groups.2

They are prepared to vote with their feet if their current company is not competitive enough.

In fact, the Consumer Reports’ 2024 survey of over 40,000 Americans with car insurance revealed that respondents who switched insurers saw a median annual savings of $461.3

Meanwhile, older drivers have the tendency to think switching companies often hurts their rates (it doesn’t). Or that there is some sort of loyalty discount for staying with the same company for years.

But those discounts may never come.

Instead all you get are increased costs for no good reason, because they know they have you and you’ll just “eat” the increases.

You may also think it’s a lot of work to find a new company.

That’s true. With +5,000 car insurance companies in the U.S., finding the best one in your specific ZIP code, for your specific age, your specific car, your specific credit score, and your specific driving history can be tough.

Not to mention insurers use complicated pricing formulas that result in prices all over the place and only cause confusion.

These new scoring models—though hidden from the public—are available to regulators. But because they’re so complex, regulators are not able to monitor them deeply.4

The truth is millennials aren’t making these calculations and reaching out to insurers one by one to see who gives them the best deal.

Instead? They’re comfortable using our online tool to compare insurance offers and find the best deals.

That’s right. We leveraged modern technology to build a tool that does all that heavy research for you:

Thousands of Americans have already used this fast, free, and easy way to shop for insurance to take advantage of discounts in 2025.

Older drivers tend to assume technology is difficult to use, but as you can see above, it’s not.

All you have to do is follow the 3 steps below (takes less than 5 minutes to find the perfect plan for you in real time):

- Enter your ZIP code, age, and current insurer below and click “Find matches”.

- A few seconds after you’ll see the top companies based on your details. Choose one and click “Next”.

- On their website you’ll see your discounted quote after answering some basic driving questions. If you’re happy with the new quote they’ll guide you through the entire switching process.

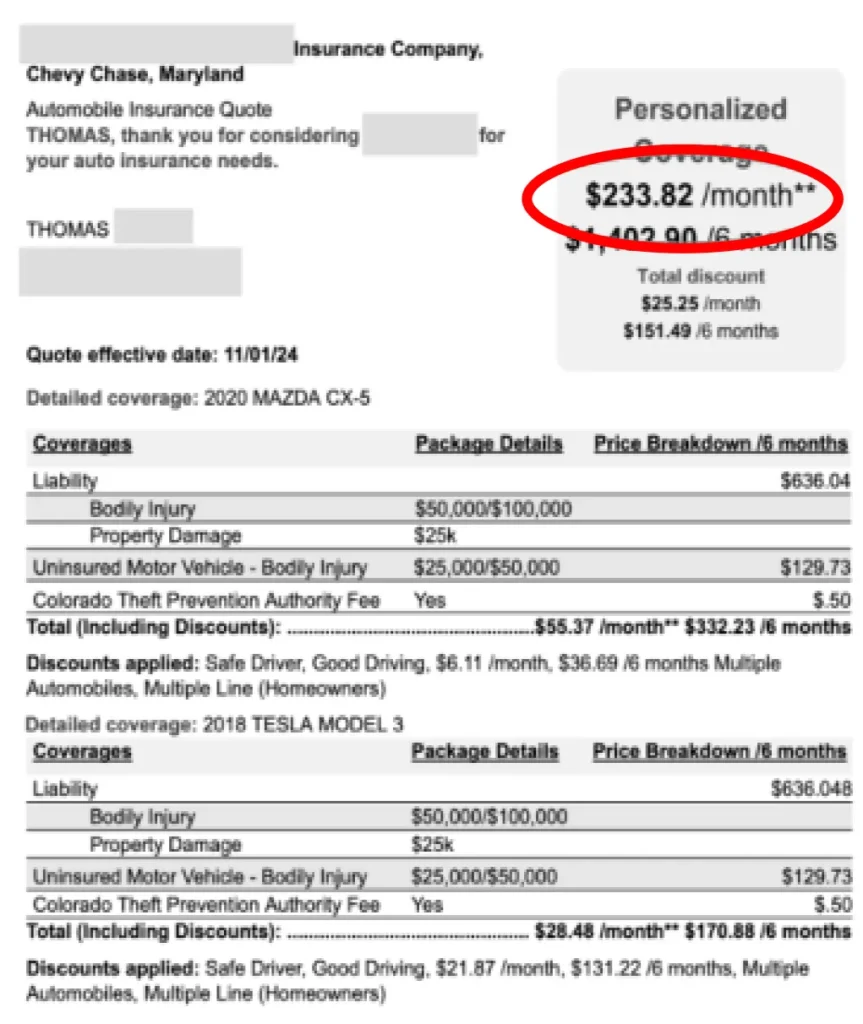

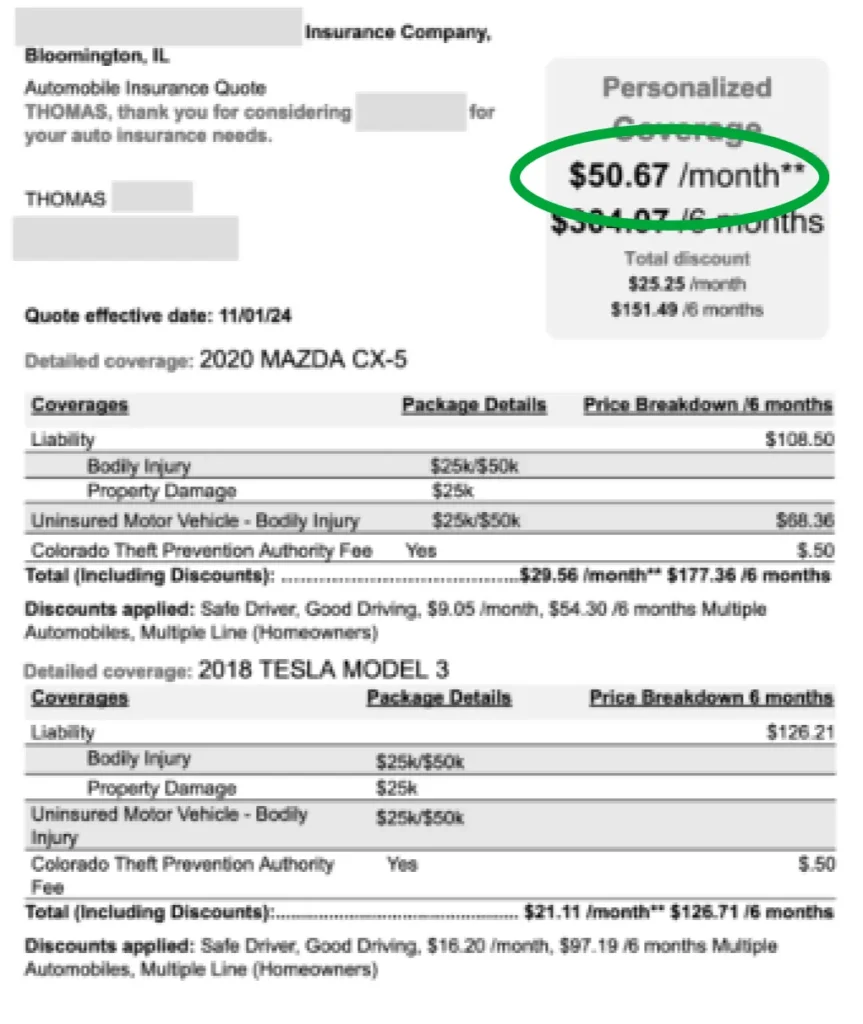

It’s that easy to check if you’re overpaying on car insurance. You don’t need to be tech-savvy to get savings like this:

*You may get a better or worse quote than the example above depending on your ZIP code, driving record, and car.

You see, people who are irresponsible with their money put off shopping for better quotes because they think the insurance industry still works like it did in the 90s.

But the people who want to save money and stay up to date with their finances, always look for better deals and leverage modern technology to work for them.

That’s why thousands of Americans have tried the tool above, because they can easily check if they qualify for high discounts and better coverage.

You’re smart enough to give it a try too, otherwise you wouldn’t have read this far.

Do it now because you may forget where to find this article tomorrow.

Remember: You’re never locked into your current policy. You can cancel mid-year (even if you’ve already paid your bill) and likely be refunded your balance.

Footnotes

- You may get better or worse savings than this depending on your ZIP code, driving record, and car. ↩︎

- https://www.fool.com/money/research/car-insurance-trends-survey/ ↩︎

- https://www.consumerreports.org/money/car-insurance/how-to-lower-your-car-insurance-rates-a9179717041/ (You may get a better or worse quote than this depending on your details.) ↩︎

- https://www.consumerreports.org/cro/car-insurance/auto-insurance-special-report1/index.htm ↩︎